GAO Issues Report on Health Savings Accounts

Who Benefits from Health Savings Accounts?

United States Government Accountability Office (GAO) Report on Health Savings Accounts: https://www.gao.gov/assets/gao-25-107480.pdf

GAO Highlights on Health Savings Accounts: https://www.gao.gov/assets/gao-25-107480-highlights.pdf

If you have a high-deductible health plan, you may be eligible for a health savings account to help you cover out-of-pocket medical expenses, tax free. Congress created these accounts 20 years ago to help people prepare for medical expenses. However, there are concerns that these accounts may disproportionately benefit some people, such as the wealthy. Today’s WatchBlog post looks at our new report on how health savings accounts work and who has one.

What is a health savings account, and what are its benefits?

Health savings accounts can be used to pay for everyday medical costs like prescriptions and contact lenses, as well as surgeries and medical exams. At the end of 2023, health savings accounts in the U.S. held an estimated $123 billion in assets. Why are people saving under these accounts? Because they come with big benefits:

- They reduce your taxable income. Contributions are not subject to federal income taxes. And contributions made through a paycheck deduction are also excluded from payroll taxes (meaning Social Security and Medicare).

- Withdrawals are also tax free for qualified medical expenses. But if you withdraw funds for other purposes (such as home repairs), they are subject to income taxes, as well as an additional 20% tax if you’re under age 65 when you make this withdrawal.

- You can earn interest and invest. While there is an annual contribution limit, unused balances may accumulate from year-to-year without limit. And funds can be invested and earn interest (still tax free).

- You can take your account with you, if you change employers or health insurance plans.

Who has a health savings account and how are they using them?

So, who is using and benefiting from these accounts? We looked at national data, and here’s what we found out:

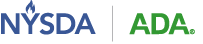

In recent years, about 43 million people (ages 18-64) annually were enrolled in health plans with high deductibles that may have made them eligible for a health savings account. But less than half of people in these plans had a linked tax-advantaged account, such as a health savings account. People enrolled through their employer were more likely to have accounts than people who purchased their health plans directly, such as through federal or state-run marketplaces.

Estimated Shares of People Aged 18-64 in Plans with High Deductibles that Had Linked Savings Accounts, 2019-2023

There are some signs wealthier and healthier people are benefitting more from these accounts than others. For example, higher income households were nearly twice as likely to have a tax-advantaged account linked to their health plan than the lowest income households. Similarly, people in excellent or very good health were more likely to have these accounts than those with medical issues.

How funds were used. In 2022, over $43 billion in health savings account contributions and $25 billion in withdrawals were reported in tax filings. Most of these contributions (84%) came from an employer or through an employee’s payroll deduction. The vast majority of money withdrawn from health savings accounts (97%) was used for qualified medical expenses. Only about 3% was used for non-qualified expenses. Most of the non-qualified expense dollars were taken out by people aged 65 and older, who are not subject to the additional 20% tax on non-qualified withdrawals. These are just some of the estimates we found in trying to answer questions from Congress about health savings accounts. To learn more about what we found, check out our new report.

.tmb-rotator.png?Culture=en&sfvrsn=e3185440_1)

.png?sfvrsn=4447de7f_1)